By: Mohammed Alsharif (frontend developer at Neufund), Niels Poensgen (music producer and programmer), Marlene Ronstedt (writer and media artist), Ahmed Alsharif (programmer and researcher at TU Berlin), Moana Holenstein (music producer and media artist)

Traditionally ownership is the state or fact of exclusive rights and control over property, which may be an object, land, real estate or intellectual property. Through tokenization ownership can be shared by a group. Similar to stock, token holders can hold a share in a company or co-own a plot of land. However, people seem to get uneasy when being confronted with the idea of partially owning a piece of art. Who wants to have the Mona Lisa’s nose if you have to share the rest?

History of Tokenizing Art

The idea of tokenizing art isn’t new. One of the first services to offer this was Ascribe.io back in 2015. By putting art on the blockchain new curation formats emerged, such as left gallery. The online gallery exhibited digital artworks and tokenized them using ascribe.io which made it possible to sell and distribute the art.

Once Ethereum allowed the creation of non-fungible tokens with the ERC-721 standard, more projects emerged. For example UJO music and coala IP. But, those ideas haven’t found any meaningful adoption outside of the blockchain space yet. The biggest hit is still Crypto Kitties. The reason for that is probably because those products were made by programmers for programmers. And not for artists, gallerists or collectors.

Art tokenization seems to have a comeback though. Last summer an Andy Warhol print consisting out of 14 electrical chairs was sold for £4.2m. The auction was processed through the Maecenas platform. The nature of the art work made it fairly easy to split it. What happens though if we cannot partition a work in 14 neat, equally sized pieces?

The Partial Art Auction

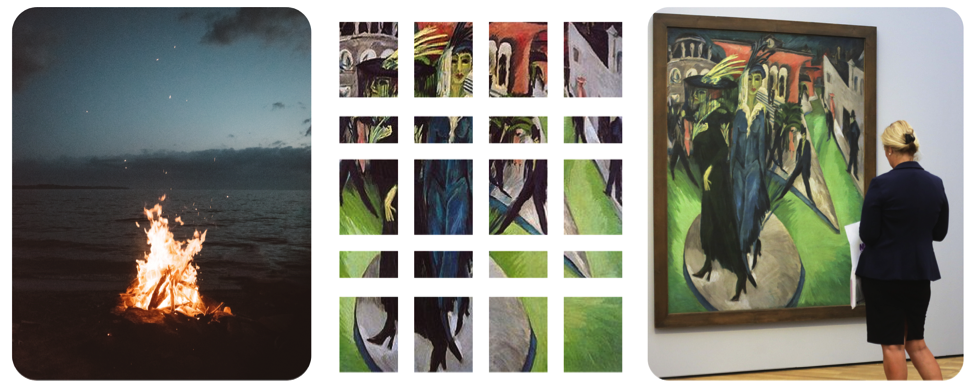

The artwork which was up for sale in the C-2 Partial Art Auction was a print of Ernst Ludwig Kirchner’s Potsdamer Platz originally from 1914. Aspiring art collectors were able to participate in the auction by making an initial payment of one cent. 20 future co-owners participated which left them initially at a 5% share of the art work and an overall valuation of 20 cents. Through bidding the equal distribution in ownership shifted and the valuation of the artwork rose.

Once the hammer hit the table the art collectors needed to figure out how to govern their co-owned property. Participants protested over the lack of roles and predefined leadership, but nevertheless were eager pump up the overall price to 78€. Our in-house art historian had valued the print previously at 2€.

A 51% attack on the artwork?

In the graphic below you can see how the ownership distribution looks like. The highest amount of tokens went to participant #2 who received 27.44% of the painting which accumulated in 2000 tokens. Second ranks participant #5 who overall acquired 1500 tokens which resulted in a 20.58% stake in the artwork. The co-ownership is distributed extremely uneven – just as wealth is IRL. It would only need those two co-owners and one other to execute a “51% attack on the artwork” as one participant described it.

The print is now co-owned by 20 collectors, the token distribution and example for a blockchain wallet in which the tokens are held.

Several proposals on how the co-owned art piece can be governed were made, but none of them was accepted by the majority. It was tricky to find consensus over potential solutions since participants would first have to agree on how to agree. A state of a-governance which some crypto economists have come to call a chicken and egg situation.

Eventually this resulted in a state of apathy in which nobody took the artwork home. There were no attempts made to steal it from the rest of the group either. And as somebody remarked, the danger of passivity in governance now also officially applies to tokenized art next to Brexit politicians.

The Token Holders Vote

Since no decision was made we let the C-2 AI take the reins. The co-owners were asked to choose between three options selected as most suitable by the AI. To avoid any further “passivity in governance” the AI choose to give every co-owner exactly one vote. Like this 51% attacks from the affluent minority could get avoided. However, that also meant that money didn’t eventually buy the co-owners more rights, but just a bigger piece of the artwork.

What should be done with the artwork?

A) The artwork will be cut into pieces and each co-owner receives their share via mail

B) The piece will be year-round on display in a Berlin gallery space and can be visited on request.

C) The work will be destroyed in a ritualistic burning and a video will be sent to each co-owner.

The Results

A majority of 60% voted for option B. To follow the will of our art collectors the artwork will be on display starting in 2020 at the Neue Nationalgalerie in Berlin. We’re happy that any awkward historical parallels were averted.

Further we noticed that Blockchain solutions are still way too complicated. Only two wallet holders unlocked their actual Ether wallets to access their tokens. We think that is fair enough since it is a pain in the arse.

C-2 is a collective of media artists, programmers and musicians exploring the concept of partial ownership. This is done by auctioning and selling art works to always more than one collector. C-2 explores then through performance, play and fiction how the relationship between several art owners can be governed before developing technical solutions.