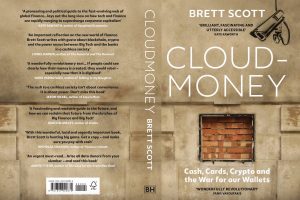

Cloud Money: Cash, Cards, Crypto and the War for our Wallets by Brett Scott

For more info, visit Brett Scott’s Substack page

Who benefits from a cashless society and who gets left behind? Is the end of cash the end of true privacy? And is a cashless future closer than we think?

Cloudmoney tells a revelatory story about the fusion of big finance and tech, which requires physical cash to be replaced by digital money or ‘cloudmoney’. Diving beneath the surface of the global financial system, Brett Scott uncovers a long-established lobbying infrastructure waging a covert war on cash, as banking and tech companies promote a cashless society under the banner of progress.

From marketing strategies against cash, to the weaponization of Covid-19 to advance fintech platforms, and the cryptocurrency rebels and fringe groups pushing back, Cloudmoney takes us to the frontlines of a war for our wallets that is also about our freedom.

Brett Scott’s Five reasons why you’ll love Cloudmoney:

I’d really love it if ALL of you could order Cloudmoney, so here are five reasons why I think you will value it, all beginning with C.

- It’s clear: it is hard to write about global monetary systems in a simple way, but the book does that. It distills the complex architecture of money into clear descriptions that a non-expert reader can understand.

- It’s critical: it doesn’t romanticise digital money and fintech, and shows why the narratives of empowerment-through-technology have a dark side. It also doesn’t hype up crypto-currency (let’s face it – there are now hundreds of books doing that). I’m not anti-tech, but I’m not easily impressed by the unbalanced claims made by many technology movements.

- It’s contrarian: the book cuts through the innovation-speak that surrounds financial technology, and provides an account of why we should protect the unsexy physical cash system. It also cuts through the often pseudo-revolutionary language that surrounds the crypto world, and gives a realistic assessment of what we can and cannot expect of crypto-tokens.

- It contextualises: the book puts things in their place. It doesn’t only show how major monetary innovations and movements relate to each other, but also sets that in the context of the vortex of global corporate capitalism and geopolitics. Finally, it sets all of this within an ecological, social and – dare I say – spiritual context.

- It provides contrast, and accepts contradiction: the book might be critical, but the point isn’t to slam-dunk digital money enthusiasts, fintech startups or crypto hopefuls, or to reject their innovations. I appreciate the enthusiasm of many people who work within those industries, but all too often their takes are given far too much airtime. The book fills in the shadow side of their narratives, serving as a contrast to rebalance them. As I note in the book’s introduction, think of this book as a darker yin to contrast with a brighter yang. Above all, I’m acutely aware of, and empathetic towards, the deeply contradictory nature of our lives in a global capitalist system, where innovations can be simultaneously empowering and destructive.

It’s available in physical form, e-book format and audiobook. Here’s some links to help you find it in your country:

The English version:

- UK: Penguin UK

- USA & Canada: Harper Collins USA (pre-order for 5th July 2022)

- Australia: Penguin Australia

- New Zealand: Penguin New Zealand

- South Africa: Penguin South Africa

- Continental Europe (English version) – search for ‘Cloudmoney’ and your region

- India – search for ‘Cloudmoney India’