Flows of capital. Evaporation. Frozen markets. Dark pools.

The implication of liquid, ungraspable condition of finance is already contained within language metaphors, widely used to describe financial markets. Speculating on the idea of economy as immaterial, abstract matter, financial experts insinuate that global economical processes are too complex to be tackled by non-expert audience, and therefore should only be a concern of ‘professionals’.

This is the opening statement of Femke Herregraven’s talk for TEDxValuz, called Geographies of Avoidance. Herregraven is a designer and researcher, whose mission can be described as melting finance back again into material condition and exposing the obscure processes running on the background of our societies.

In her talk, she quotes German philosopher Georg Simmel: “Money, more than any other form of value, makes possible the secrecy, invisibility and silence of exchange.”

Today, finance resembles alchemy. Money can be created purely out of the circulation of money, magically materializing from itself. Capital flows are merely perceived as abstractions and read in forms of signs, metaphors and linguistic exchanges. Wealth that once had a material condition and was contextualized by its territory is now disconnected from a specific place, labor or material production. Value transformed into a network of offshore tax havens and hedge funds.

Offshore financial centers are less and less associated with tropical islands and Mafiosi: today they stand at the very core of mainstream global economy. Wealthy OECD countries offer multinationals opportunities to evade financial regulation legally, allowing large sums of capital to accumulate in their jurisdictions. Other nation states are forced to lower their corporate taxes more and more in competition for the investment. Countries begin to brand themselves with taxes. Meanwhile, the principles of the rising offshore economy remain hidden and inaccessible for public.

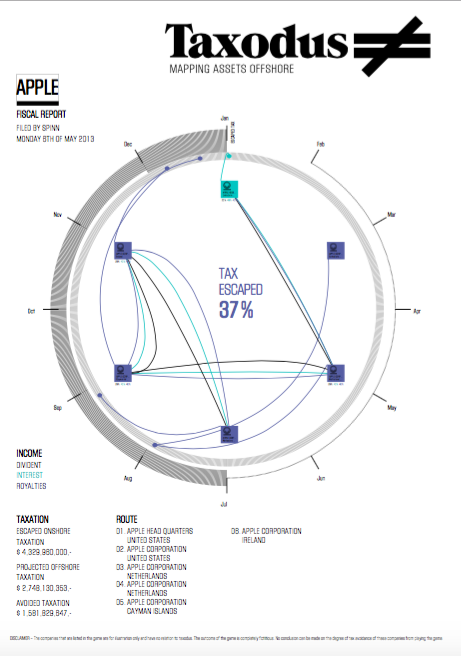

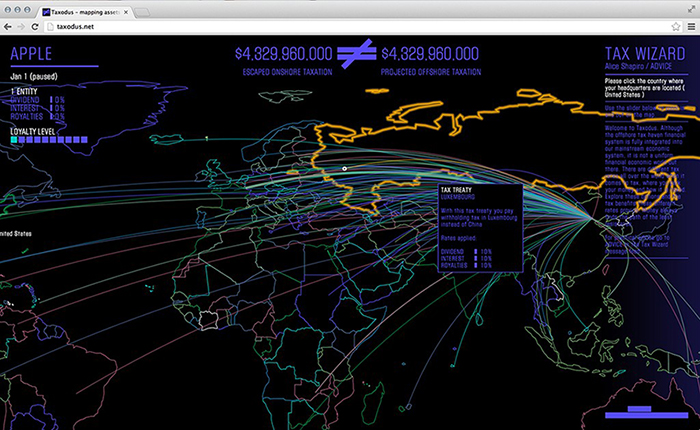

Aiming to reveal invisible pathways, Herregraven designed Taxodus, “a serious web-based game”, which invites users to play on behalf on the multinationals and to dodge paying as much tax as they can. By setting up intermediate holdings globally, players explore potential routes through which multinationals in reality can “neutralize” their tax burdens. In the end players receive their scores in a form of a fiscal report.

The game is based on real data on international capital flows, such as national tax treaties. Taxodus is designed to become a public interface to knowledge, which is today exclusive to the fiscal lawyers and accountancy firms. According to the author, it can be a tool to navigate, deconstruct and

reflect on economical structures, linking immaterial flows back to geographies, jurisdictions, nationhood and material object.

Dedicated to track the hidden, Herregraven’s work resembles a treasure hunt. But instead of looking for gold, she found herself subscribed to an eternal search for the most boring things imaginable. Cables. Doors. Plugs. Walls. Physical elements that stitch the global infrastructure together. Within The All Infrared Line project she investigates historical and current manifestations of communication networks that support the international markets. In the end, the alchemy of tax evasion, data transfers or high-frequency trading is deeply dependent on its material backbone. Demystification of finance begins when the seemingly abstract matter meets spaghetti of submarine cables.

The irony is that even the stakes of far-fetched financial investments are often based on materiality. In Herregraven’s Volatility Storms, she illustrates how catastrophe bonds can turn hurricanes, earthquakes, tsunami or ice melting into financial products, allowing investors to bet and monetize on global warming. Today economies are being shaped by landscapes just as much as landscapes are being carved by economies.

I believe Femke Herregraven is trying to tell us is that we should not fear the complexity of the software running behind the surface. Rather then offering a solution, she forces transparency over the financial structures, allowing users to play by the rules of real geopolitical chess. Opening up the black box of information, she passes the rights to debate and discuss the financial markets to a wider audience.

After all, it is up to us to decide what to do with this knowledge, and how far do we want to go chasing the shadow. Imagination is all it takes.

Visit artist’s website: femkeherregraven.net