Session 1

Speakers: Micky Lee, Brett Scott, Ana Teixeira Pinto, Reijer Pieter Hendrikse

Moderator: Geert Lovink

——

MoneyLab #7 kicked off with a session of fireworks. Micky Lee, Brett Scott, Ana Teixeira Pinto, and Reijer Pieter Hendrikse delivered four spectacularly specialized yet wildly varying talks to the crowd in Tolhuistuin. As if this wasn’t enough, all four speakers crammed the absolute maximum of facts, models, narratives, jokes, and analyses into the fifteen minutes at their disposal. So, for those who felt as overwhelmed as I did, or who didn’t make it to the event, here’s a little recap.

Micky Lee – Disruptive Technology: The Tulip

In the first statement of the conference, Micky Lee set the stage for two days of sharp, feminist, localized critiques of finance by turning to a feminist, decolonial critique of the Dutch 17th-century tulip mania. The urgency of this statement? Lee: ‘A feminist intervention is much needed in finance not because it can prevent a financial crisis from happening, but because it shows how wrong mainstream economic thoughts are about financial crises.’

The major take-away insight concerns general misunderstandings around the nature and origins of financial crises. For financial crises, Lee argues, are not human made. That is to say, they are not simply the inevitable effects of intrinsic human flaws. They are instead the result of clashes between ‘the multiple, heterogeneous, and fragmented spatialities and temporalities created by human and non-human actors’. As such, they should be acknowledged as both gendered and technological.

Jan Breughel the Younger, A Satire of Tulip Mania, ca. 1640. Monkeys dressed as upper-class speculators lose their brain.

What exactly is the tulipomania narrative? ‘Tulip mania’, Wikipedia explains, ‘was a period in the Dutch Golden Age during which contract prices for some bulbs of the recently introduced and fashionable tulip reached extraordinarily high levels and then dramatically collapsed in February 1637. It is generally considered the first recorded speculative bubble.’ Even though leading scholars agree that the tulip mania did not ruin the Dutch economical hegemony, the imaginary of the big crash, painted by many a moralist painter remains firmly in place. Lee explains this persistence of the tulipomania bubble story by arguing that it has become the ahistorical story of the mother of all crises, which conveys a kind of archetypal, timeless truth about human nature. The characteristic which makes the tulip mania story so easy to understand and uphold as a universal truth, is that it hinges on a simple binary opposition supposedly present in every entrepreneurially minded human-being. If there is, on the one hand, rationality, prudence, and good entrepreneurship, there is irrationality, excess, and greed on the other.

Hendrik Gerritzs Pot, Wagon of Fools, 1637. Flora, goddess of flowers, rides to her destruction in the sea, followed by the citizens of Haarlem.

Lee deconstructs the binary present in the tulip bubble story. She argues that rather than a universal truth about human nature, the binary lays bare cultural and gender bias. The positive pole of the binary (equilibrium), according to Lee, represents the West. The negative pole (crisis) represents the backward, exotic, oriental origin of the flower tulip – that is, the East. Moreover, just as qualities of the positive pole are traditionally associated with masculinity, the qualities of the negative are traditionally related to femininity.

How did we come to such universalization? The myth goes like this:

The tulips grown in the garden of Turkish rulers for their pleasure exclusively, are like the women kept in their harems. Both these women and flowers are threats to the empire, for they might distract the male ruler from his duties in defense of the country. Acknowledging this threat in its native country, Western importers of the flower should ask themselves: If a flower can bring down an empire, what could it do to the economy? Clearly, the tulip makes people who are normally rational into irrational individuals. The flower therefore needs to be confronted, i.e. the East needs to be conquered. The first step in the conquest is rather easy. It is to feminize the flower by describing it in terms of ‘beauty’, ‘elegance’, etc. Tulips are like the harem women after all. If it is considered feminine, that will already make it a bit less valuable and threatening. The second phase of conquest is somewhat harder, even though still easy enough. Through understanding the tulip in a (masculine) scientific manner, the mystery of the East can be unraveled and theoretically tamed. The scientific taxonomizing of the tulip strips the flower of its feminine, Eastern mystery and unveils a timeless truth, a universal understanding of the flower.

As the story of tulipomania lives on, the binary at its foundation keeps haunting present-day society. Every new crisis or bubble, whether it’s a bubble in the financial or property markets, is presented as proof that people have remained just as stupid over the course of the past four hundred years. High-tech Silicon Valley companies are ruled by exactly the same ‘insanity of lust and greed’ as the tulip traders of 17th century Holland.

Yet, we should be wary of this type of universalization. When we talk about financial crises and why feminist interventions are needed, it’s because universalization always lurks around the corner: what works here, should also work there. The feminist critique reminds us of the local characteristics of crises.

* This talk was based on a chapter of Lee’s new book Bubbles and Machines (Westminster UP). Download the book free of charge here. It also builds on two blogposts for the INC website found here and here.

Brett Scott – Changing the Faces of ‘Digital Cash’

Brett Scott took his fifteen minutes of stage time to ‘sketch out a framework’ for understanding the notion of digital cash. If Micky Lee’s statement was already high-paced, Scott really entered the highroad of theory. Somehow, Scott managed to insert a jokes or puns into every second sentence, which saved the listeners in the room. This humor I can’t reproduce here, though, so I’ll stick to the clean, dry theory.

Digital cash is a neologism similar to e-mail: an electronic version of something old. But as we can see with e-mail, the e-version does not displace actual mail, but rather the fax. What is digital cash actually replacing? Cash?

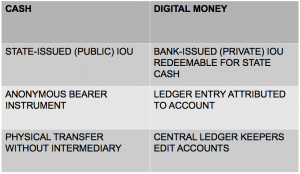

Before finding out what digital cash is, it should be established what cash and digital money are. (Image from Brett Scott’s slides.)

What is cash?

- Cash is issued by states or state-backed institutions. It is in fact the only form of state money that can be held, and that can thus be directly accessed by its users.

- Cash is a bearer instrument. Whoever holds it, controls it. It needs no track record, no identity of owner attached, and therefore is an anonymous form of money.

- Cash is transported physically.

What is digital money?

- Digital money is issued by private banks. Bank accounts are private promises for state money attributed to you by your bank. We can’t individually interfere in the bits and bytes of the data systems, but we have to send messages into multi-layered communication systems governed by banks.

- Digital money is a ledger entry attributed to account. As such, it is opposed to the bearer instrument cash. Digital money is not simply controlled by its holder but needs a track record tracking identity of its subsequent owners to establish whose it is at any point of time.

- Central ledger keepers edit accounts. That is to say, a central body such as a bank controls and surveils user accounts, and thereby holds the power to (digitally) transport ledgers from one account to another.

This analysis provides a nice, insightful table:

This immediately shows that two payment methods that pretend to be digital cash, really are not: PayPal and Prepaid Cards. In the case of PayPal, you hand in cash and they exchange it for private promises. PayPal units are simply promises for bank money. As for prepaid cards, you give cash to somebody, which is stored in a bank account, the card gives you anonymous access to a part of this bank account.

What about cryptocurrencies? The Bitcoin White Paper (2009) promised to truly create digital cash. Its system exists as one giant public database which everyone can go into and make an account. From this database then bitcoins are mined, which means that non-state, non-bank blank token are created. Like bearer instruments, these tokens are slate objects with no features to it beyond the fact that it’s an object. However, like ledger entries, they are then attributed to specific accounts. Bitcoin is thereby a hybrid between a ledger system and a bearer instrument. You need to complete a ledger function, but you need no third party to complete it for you. (All the different cryptocurrencies established since are basically the same, with small differences.) The big downside for all of these cryptocurrencies is that they are per definition blank objects.

Some cryptocurrencies have tried to solve the blankness-problem by tying the cryptocurrency to traditional currencies. For instance, the USD coin is a free ecosystem of a cryptocurrency like any other, based on the private, more stable ecosystem of the USD. Facebook’s Libra came up with a similar concept, ultimately tying the cryptocurrency back to the USD. Cryptocurrencies here function as meta-objects referencing sub-systems, which eventually ties back into the state-issued money system.

This conjures the next question: shouldn’t central banks simply start to issue electronic money themselves? This idea seems to fit the The War on Cash central to surveillance capitalism. However, central bank-issued digital cash would bypass the banks, going directly into digital wallets of citizens, so this would have a huge impact on the banking system. At the same time, these new infrastructures would be controlled by the state and not be decentralized. This might be attractive to states for surveillance reasons.

Ana Teixeiro Pinto – Bitcoin and the Basilisk

Ana Texeiro Pinto took the techie discussion around Bitcoin, AI, blockchain, and the digital economy to another level. She did not so much question the technologies’ material properties but rather the (gendered) fantasy that led to their creation – and the fantasy that their creation conjures. For the discourse around tech seems always to be in excess of the actual technological possibilities. Our dreams of AI lovers, computer learning, and holiday trips to Mars make present-day cutting-edge technologies look like they’re tools from the Stone Age.

Pinto’s approach to technology is in line with Klaus Theweleit’s analysis of the German Freikorps in his famous Männerphantasien: to understand their origin they should be examined as form (fantasy) rather than function (materiality). When taken as the product, pure ideations beyond any material properties or use value, there is libidinal validity (however grotesque) in these male-dominated personifications. The obsessive focus on technological progress found among transhumanists, effective altruists, and Bay Area techno libertarians can be explained as driven by paranoia, FOMO and the fear of loss of control. In being repressive counter-reactions, tech fantasy testify to a real crisis in male identity.

Pinto took as an example the paranoid yet common fantasy of AI as the future rule who should be obeyed in advance and shows that The Matrix was not its first cultural manifestation. In 1909, Filippo Tomasso Marinetti published his novel Mafarka: The Futurist, in which he propagates ‘the fertilization of the male spirit’. The novel, which is the story of an airplane-shaped, basilisk-like creature called Mafarka and his quest for reproduction without women, shows that the origin of the fantasy of technologically facilitated homoreproduction is male autarky. In the preface to the book, Marinetti states:

In the name of the Human pride that we adore, I tell you that the hour is near when men with broad foreheads and chins of steel will give birth prodigiously, by one effort of flaring will, to giants infallible in action […] I tell you that the mind of man is an unused ovary […] It is we who will be the first to impregnate it.

Pinto unpacked the consequences of this analysis, jumping from Jason to psychoanalysis and finally to Bitcoin, concluding that it is the product of the same male anxieties as Mafarka:

Economically speaking, Bitcoin is the answer to the wrong question: the problems with value fluctuations are not formal but political, they cannot be solved by software engineering […] Bitcoin reflects deep-seated anxieties about “foreign” control of the Federal Reserve, and more broadly, an anti-Semitic creep marked by the putative illegitimacy or unnaturalness of Financial capital. In a nutshell Bitcoin, like Mafarka, is a fantasy about parthenogenic value.

Seeing the current shift of global hegemony, which we might call de-Westernization, it is not surprising that privileged white men in the Valley turn to parables like that of the AI dominator, devoting their lives to the Basilisk. Following what seem to them only way to counteract the otherwise inevitable rise of Asian dominance and save racial capitalism, the tech-savvy geeks gathered tendencies like the alt-right simultaneously embrace neoliberal power, techno-libertarianism, and neo-Fascist attitudes.

Rijer Pieter Hendrikse – Offshore: How Capital Rules the World

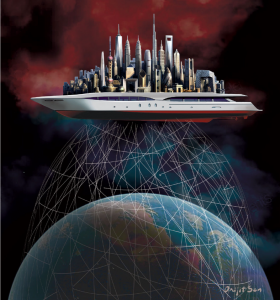

An image of a superyacht carrying all the world’s high-rises, connected to earth only by a network of strings, makes up half of every slide in Rijer Pieter Hendrikse’s presentation. This painting by Orijit Sen might, Hendrikse explained, be the best visualization of world capital today. It’s like Pan Am in the Hunger Games: privileged, not paying taxes, ruling over the second-class ‘districts’ that constitute the rest of the world. We call the Pan Am of our world Offshore.

Offshore finance is the new way of the world. All the world’s 250.000 billionaires and major corporations factually live offshore. It’s a country of its own. The only prerequisite for this global world to have emerged, is global capital mobility. Money goes where it is most unrestricted by taxes and other obstacles.

Every sovereign country can write unilateral legislation for offshore, creating two parallel legal systems: for ‘residents’ and ‘non-residents’. Money can reside in a country, entering and leaving through mailboxes, without ever entering the country’s actual economy. About 100 countries actually do this, major players including the Commonwealth, the Netherlands, Belgium, Luxembourg, and Hong Kong. It can be argued that the sovereignty of countries is decomposed and financialized by this development – instead postulating capital as the new sovereign (surveillance capitalism). And while capital becomes more and more sovereign, and it becomes increasingly legal to avoid paying taxes, social contracts are breaking up.

This development can be traced back to the late 19th century, when companies/corporations started existing as independent non-state organizations and bilateral tax treaties were created to facilitate the flow of capital. Then, after WWII, this tendency took flight through bilateral investment treaties, assuring the prolonged control over post-colonial markets and corporations, and the birth of the Eurodollar market in the City of London.

Tech and offshore seem to rub shoulders, or even to synthesize and together become dominant power. Look at Trump, Putin, Duterte, Bolsonaro, the Chinese princelings, or other strongmen: they all live offshore, they all use tech (social media, AltRight, surveillance capitalism, platform economy) to claim their power. A synthesis was established between offshore neoliberal capitalism and illiberal nationalist politics. This seems to be a global development. ‘It’s just neoliberalism dressed in new clothes.’ It’s the same old race to the bottom. However, China is taking over the lead in the race this time. It’s the end of the end of history.

* This lecture was partly based on an article co-authored by Hendrikse and Rodrigo Fernandez for Transnational Institute, which can be found here.

Discussion

Geert Lovink: Even though they differ a lot, there is a common thread in your presentations, in the sense that you’re asking the same basic questions. How should we look at things that appear at first to be contradictions? How to push the boundaries of our thinking to develop new political strategies?

Audience: Can we see more feminist historical perspectives in art on financial bubbles and crises?

Micky Lee: The book Tulipfever. This book is critical, but not so feminist after all: the woman is punished for passing over into the (masculine) public sphere. The lesson learned: being a woman, you shouldn’t pass over into the public sphere.

Geert Lovink: Look at Tulipomania.com, in 2000, peak of the dot.com boom.

Audience: So what? What does tulipomania say about bubbles today? What does digital cash mean in terms of dominant power? What are you guys suggesting? What’s the relevance, in two sentences?

Rijer Hendrikse: Indeed, whole new world emerging through old hegemonic cycles. Unprecedented technological possibilities to deepen hegemonic structures, that’s worrisome.

Ana Teixeira Pinto: What’s happening in the world right now urges us to rethink the notion of fascism. We tend to see it connected to mass movements, which is not what’s happening today. It has to do with freedom from the masses today, and therefore it is dwelling on social media. We should rethink historical fascism and the body politic (society as a body). What is feminist finance? We have to go into these gendered and racist issues.

Brett Scott: I don’t know why you should care. I just want to get some definitions clear. The Libra-discussions in mainstream media are full of confusions. But I will say that these online money-systems will be the basis of capitalist healthscape. This might form the foundations for The Matrix.

Micky Lee: Your own understanding of money is as good as that of offshore bankers.

Audience: Continuing on the so what: MoneyLab is interested on the critique and aesthetics of finance. But why not get involved in the protocols of money? What makes the panel excited? Isn’t Bitcoin exciting?

Geert Lovink: MoneyLab and all of the INC projects bring together people who are interested in critique and alternatives. But what does that mean now, here? This is the challenge. Six years after the establishment, we’re much further in thinking about these issues, and we’re no longer just talking concepts (even though they remain powerful).

Brett Scott: You (Economic Space Agency) are working on these things. I’m highly supportive of what you’re doing, and we have a big battle coming up. We have to do rhizomatic bottom-up systems.

Audience: A question on the War on Cash. States are worried about losing control. But isn’t it the real danger for Apple and Uber, because they’re having the data and can lose it?

Brett Scott: These companies are not doing the actual banking. They just control the interface layer, while the banks doing the plumbing. These companies are dead against cash, because they can’t automate cash.